European Union

Oil in UAE

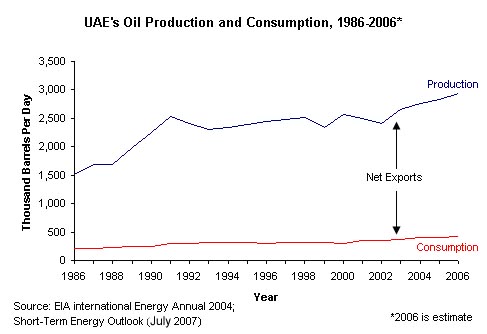

In 2006, EIA estimates that the United Arab Emirates (UAE) produced 2.9 million barrels per day (bbl/d) of total oil liquids, of which 2.5 million bbl/d was crude oil. The UAE also produced an estimated 300,000 bbl/d of natural gas liquids (NGLs) and 102,000 bbl/d of condensate. UAE oil consumption averaged 423,000 bbl/d in 2006, with the majority of production exported to Asian countries. Foreign Minister Sheikh Abdullah bin Zayed al-Nahyan announced in April 2007 that UAE oil production capacity will increase to 5 million bbl/d by 2014, increasing the UAE’s profile in the region.

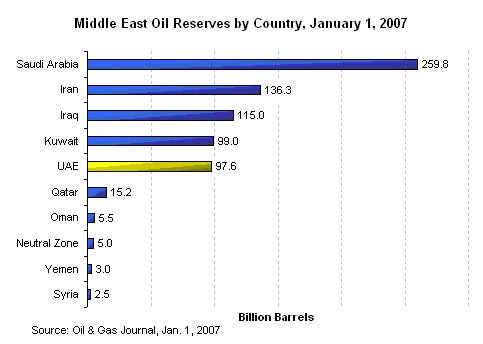

According to Oil & Gas Journal(OGJ), the UAE’s proven oil reserves were 97.6 billion barrels as of January 1, 2007. Abu Dhabi leads the other emirates with 92.2 billion barrels followed by Dubai with 4 billion barrels, Sharjah with 1.5 billion barrels, and Ras al Khaimah with 500 million barrels. The UAE holds the fifth largest proven oil reserves in the region. UAE crude streams are expensive due to their light and sweet composite compared to other Middle Eastern producers. The API gravity ranges from 34 to 36.8 degrees in the Zakum field, to 40.4 degrees in Murban.

Sector Organization

The largest state owned company is the Abu Dhabi National Oil Company (ADNOC), which operates 17 subsidiary companies in the oil and natural gas sectors. ADNOC maintains the right to take up to 60 percent stake in new major oil projects. Hydrocarbon production is handled on a production sharing basis between state-owned companies and foreign investors. The majority of Abu Dhabi’s oil production is under the Abu Dhabi Company for Onshore Operations (ADCO), as well as the Abu Dhabi Marine Operating Company (ADMA-OPCO) and the Zakum Development Company (ZADCO.)

The Supreme Petroleum Council sets energy policy, and oil is the main focus of the UAE’s hydrocarbon policy under Oil Minister Mohammed al-Hamli, who is also the 2007 OPEC President. Foreign investors have a relatively limited role outside of exploration. Foreign contracts tend to fall under an engineering, procurement, and construction (EPC) basis.

Exploration and Production

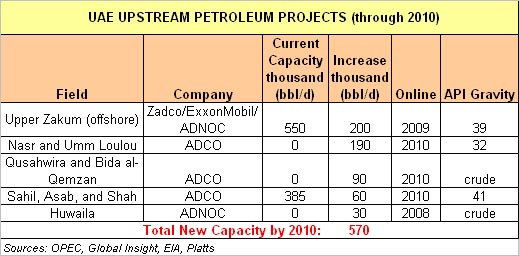

The UAE oil reserves account for 8.5 percent of total world reserves, most of which are located in Abu Dhabi. According to Global Insight, the Zakum oil field is the largest in the country, and the third largest in the Middle East, with an estimated 66 billion proven barrels. The UAE has committed itself to infrastructure development and enhanced oil recovery techniques in mature fields. The Upper Zakum project is a partnership between ADNOC, ExxonMobil, and Jodco to increase the Zakum production capacity by 200,000 bbl/d. Increases in production are also expected on onshore fields, Bu Hasa, Bab, and Asab, as well as north-eastern fields, al-Dabbi’iya, Rumaitha, and Shanatet. The government hopes that increased production capacity will make the UAE a ‘swing’ producer, strengthening its role and influence in the region. However, new exploration has been disappointing.

Pipelines

The Emirates have a network of domestic pipelines linking fields with processing plants and exit ports for trade. There are also inter-emirate pipelines primarily for natural gas injection to increase oil recovery levels in existing Dubai oil fields. The Dolphin natural gas project linking Qatar (See Qatar Country Analysis Brief) and the UAE is the most important recent development in the area (see Natural Gas Section for more information.)

Exports

UAE lies on the Persian Gulf with a number of ports available for shipping crude oil and natural gas exports. The main terminals are: Jabel Dhana, Zirku Island, Das Island, and Ruwais. Jabel Dhana exports from Abu Dhabi’s Asab, Bab, Bu Hasa, Sahil, and Shah oil fields. According to the EIA, Japan imported 1.36 million bbl/d from the UAE in February 2007, which is 54 percent of the UAE’s total net petroleum exports.

Refining

According to OGJ, the UAE had 781,250 bbl/d of refining capacity at five facilities as of January 1, 2007. The three main refineries are Ruwais, Umm Al-Nar, and Jebel Ali. The largest two are ADNOC’s Ruwais with a 350,000 bbl/d capacity and Umm Al-Nar with a 150,000 bbl/d capacity. All substantial upgrades have been offered on an EPC basis, and there is discussion over larger roles in refining for private investors. Abu Dhabi’s investment arm IPIC and ConocoPhilips signed a deal in 2006 for a new refinery with 500,000 bbl/d capability.